A few weeks back, the whole world woke up to the second administration of Donald Trump announcing tariffs. Confusion was rampant, and opinions divided. Leading economists from across the globe said that this move can disrupt the current globalized economy.

The world we have today is globalized. Businesses rely on cross-border supply chains, diversified markets, and international partnerships to drive growth and profitability. But over the past few years, shifts in trade policy—particularly the tariffs imposed by the Trump administration—have disrupted this delicate balance. These tariffs, aimed at protecting domestic industries, triggered a wave of economic repercussions that challenge multinational businesses today.

“From 1789 to 1913 we were a tariff-backed nation, and the United States was proportionately the wealthiest it has ever been… Then in 1929 it all came to a very abrupt end with the Great Depression. And it would have never happened if they had stayed with the tariff policy,” said 47 during a press conference.

The history of tariffs in the United States has evolved significantly—from a primary revenue source in the late 18th century to a tool for protecting domestic industries. More recently, a strategic instrument in international trade negotiations. Early tariffs aimed at funding the federal government gradually shifted toward industrial protection, especially during the 19th century.

Protectionism peaked with the Smoot-Hawley Tariff Act of 1930, which worsened the Great Depression and led to global retaliations. This prompted a turn toward trade liberalization, starting with the Reciprocal Trade Agreements Act of 1934 and continuing post-WWII through the creation of GATT and later the WTO.

For decades, tariff levels declined, and trade agreements expanded. However, the Trump administration reversed this trend by imposing broad tariffs on imports from key partners like China, India, and the EU citing national security and unfair trade practices.

These actions sparked retaliatory measures and reignited debates over the role of tariffs. This has culminated in current policies like universal base and reciprocal tariffs, which mark a return to aggressive protectionism with wide-reaching global implications.

From increased production costs to strained supplier relationships, the ripple effects are widespread. Companies that once operated seamlessly across borders are now facing the complex task of restructuring operations, reassessing market entry strategies, and re-evaluating risk exposure in tariff-affected regions. The uncertainty has pushed many organizations to seek new ways to maintain competitiveness without sacrificing scalability or efficiency.

In this blog, we’ll explore the broader impact of these tariffs on businesses and how Datamatics can serve as a valuable partner—guiding businesses through market research, data-driven decisions, demand generation, and content syndication to thrive in a rapidly evolving global market.

Select an element to maximize. Press ESC to cancel.

Select an element to maximize. Press ESC to cancel. Select an element to maximize. Press ESC to cancel.

Select an element to maximize. Press ESC to cancel.But first, what is a tariff?

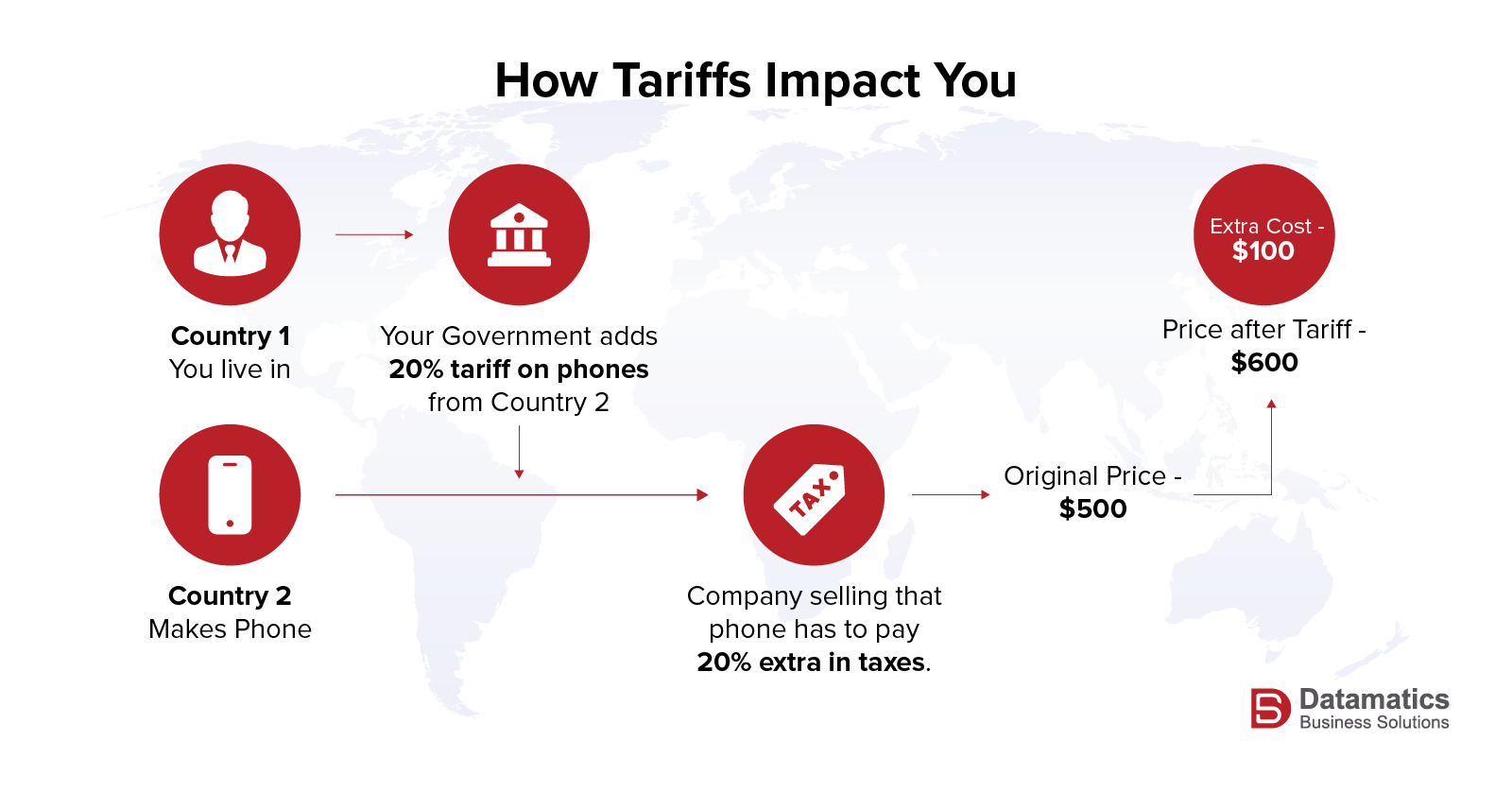

A tariff is basically a tax that a government puts on goods coming into the country from somewhere else.

But why do governments use tariffs? Well,

To protect local businesses – If phones made in the U.S. are $600, and the Chinese one is $500, people will buy the cheaper one. But if a $100 tariff is added to the Chinese phone, both cost the same—and now American companies can compete.

To raise money for the government – The extra money paid as tariffs goes into government revenue.

To pressure other countries – Sometimes countries use tariffs to push other nations to change their behavior, like following trade rules or stopping unfair practices.

Select an element to maximize. Press ESC to cancel.

Select an element to maximize. Press ESC to cancel.Who Got What?

Universal Tariff:

- A baseline 10% tariff applied to imports from most countries.

Country-Specific Tariffs:

Special Cases:

- Canada and Mexico: Initially faced 25% tariffs, later adjusted with exemptions for certain goods under the USMCA.

- Countries importing Venezuelan oil: Subject to a 25% tariff on all goods exported to the U.S.

Understanding the Impact of Tariffs on Global Businesses

As the Trump administration introduced a series of tariffs on imports from almost all countries, it started a significant shift in global trade dynamics. These protectionist measures, while aimed at bolstering domestic manufacturing, has far-reaching consequences for businesses operating in an increasingly globalized economy.

Larry Summers, former U.S. Treasury Secretary described the tariffs as “a self-inflicted wound to the American economy,” expressing concerns about the potential for increased inflation.

Many economists expressed concerns that the tariffs would lead to higher consumer prices, and negatively effect the global economy.

Companies that had established multi-country supply chains are being hit hard. Input costs have surged, production timelines have disrupted, and retaliatory tariffs from other nations created uncertainty across markets. For instance, manufacturers dependent on imported components are facing higher costs, which either are squeezing profit margins or passing prices onto customers—often at the expense of competitiveness.

Trump’s tariffs have injected significant volatility into the stock market as well. Trade-related news triggered rapid market swings, with uncertainty about economic growth and corporate earnings fueling investor anxiety. Sectors reliant on international trade, like manufacturing and tech, are taking the blow.

Global markets mirrored this volatility, reflecting the interconnected nature of the economy. Fears of a trade war and economic slowdown intensified, impacting investor sentiment. While the long-term effects are debated, Trump’s tariffs are undeniably creating a period of heightened market uncertainty and fluctuation.

The COVID Disruption

The COVID-19 pandemic caused one of the most significant global economic disruptions in recent history. It led to widespread supply chain breakdowns, factory shutdowns, and labor shortages, particularly in manufacturing hubs like China, India, and Southeast Asia. As countries locked down, demand for certain goods (like electronics and home essentials) surged, while others plummeted. Shipping delays, port congestion, and raw material shortages exposed the fragility of global supply chains.

Businesses faced increased costs, uncertain timelines, and shifting consumer behavior. Many companies were forced to rethink their sourcing strategies, invest in digital transformation, and explore regional or nearshore alternatives to reduce risk. The pandemic accelerated trends like e-commerce growth, remote work, and the need for agile, data-driven operations across industries.

In short, COVID-19 didn’t just cause temporary disruption—it reshaped how global business is done, pushing resilience, diversification, and digitalization to the forefront.

Disruption or New Opportunities in the Horizon?

In the wake of the United States’ imposition of tariffs—such as the 145% levy on Chinese imports and a universal 10% baseline tariff—several countries have emerged as significant beneficiaries, capitalizing on the resulting shifts in global trade dynamics.

Mexico: Leveraging its proximity to the U.S. and the advantages conferred by the U.S.-Mexico-Canada Agreement (USMCA), Mexico has seen a surge in manufacturing investments. Its share of U.S. goods imports increased from 13.6% in 2018 to 15.5% in 2024, positioning it as a prime nearshoring destination for companies seeking alternatives to Asian suppliers.

Brazil: Facing comparatively lighter tariffs, Brazil has benefited from increased demand for its agricultural exports, especially soybeans, as China seeks alternatives to U.S. suppliers.

Egypt and Morocco: These nations have seized opportunities in sectors like textiles and exports, bolstered by reduced competition and existing trade agreements.

Singapore: As a global trade hub, Singapore is attracting investment and expanding its manufacturing footprint, benefiting from the realignment of supply chains.

India: Embracing the “China Plus One” strategy, India is attracting companies diversifying their manufacturing bases. Its stable government and growing economy are making it an appealing destination for investment.

These developments underscore a significant reconfiguration of global trade relationships, with emerging markets stepping into roles previously dominated by traditional manufacturing powerhouses.

How Datamatics Supports Businesses in a Shifting Trade Landscape?

In a world of rising trade barriers and shifting global dynamics, companies can no longer afford to operate on assumptions. Success today hinges on making smart, data-backed decisions about where to do business—and how to do it right.

Trump tariffs has disrupted the world. Companies are looking for new markets. And as new markets emerge, finding the right footing can be challenging—uncertainty is high, and the risks even higher.

This is where Datamatics becomes a critical partner. We don’t just support your expansion. We do the heavy lifting to help you break into new markets with confidence. Whether you’re exploring fresh opportunities due to Trump tariff disruptions, looking to relocate operations, or simply targeting high-growth regions, Datamatics helps you chart the course from discovery to dominance.

We start by identifying the right markets for your business. Our market research and Total Addressable Market (TAM) analysis provide clarity on not just where your potential lies, but how big it really is. Using a combination of AI-driven insights and human intelligence, we can help you uncover tariff-friendly geographies, forecast market trends, assess competitive landscapes, and map growth potential. And all of this can be customized to your industry.

But market discovery is just the beginning. With Datamatics, you also get a tailored Go-To-Market (GTM) strategy that aligns your value proposition with the market’s demand. We help you identify the right audience, craft a compelling positioning strategy, and determine the best channels and messaging to activate your presence—efficiently and effectively.

From there, we help you accelerate growth with our AI/ML-powered demand generation solutions. We segment your ideal customer profiles (ICPs), pinpoint key decision-makers, and engage them with hyper-targeted campaigns that convert. Our data solutions ensure you’re not only reaching the right people but doing so with verified, high-quality data that drives action.

Accurate data is the foundation of every successful GTM motion. That’s why we pair our marketing expertise with clean, compliant, and actionable data that is vetted through both AI and human validation. When your data is solid, your decisions are sharper—and your market entry strategy becomes far more effective.

Finally, we bring it all together with high-precision demand generation, content syndication, and Account-Based Marketing (ABM). Our ABM approach enables you to go deeper into key accounts with personalized outreach, aligning sales and marketing to drive faster conversions and higher deal values.

At Datamatics, we don’t just help you enter new markets. We help you own them—with intelligence, strategy, and speed.

What’s Next?

We don’t know. We’re in a state of uncertainty. While the Trump administration has paused most tariffs for the next 90-days—except the baseline rate—for all countries other than China, the future of global trade remains unpredictable. But in times like these, being prepared is a competitive advantage. When the rules are shifting, clarity is power.

At Datamatics, we help businesses navigate uncertainty with confidence. By combining global data intelligence with targeted outreach strategies, we empower organizations to remain agile, informed, and resilient—regardless of what trade disruption comes next. Let’s explore how we can future-proof your growth strategy. Get in touch and let’s chart the course—together.

Subscribe to our blogs and always stay on top of industry trends.

Somnath Banerjee